A Business Continuity Plan Can Help Protect Your Business From Unexpected Changes

Betty has been your company’s payroll clerk for a long time. She’s reliable, gets things done and payroll is one less thing you have to worry about because she’s happy to take care of it all. In fact, you have no idea what you’d do without her until one day you’re unexpectedly forced to realize this unfortunate reality.

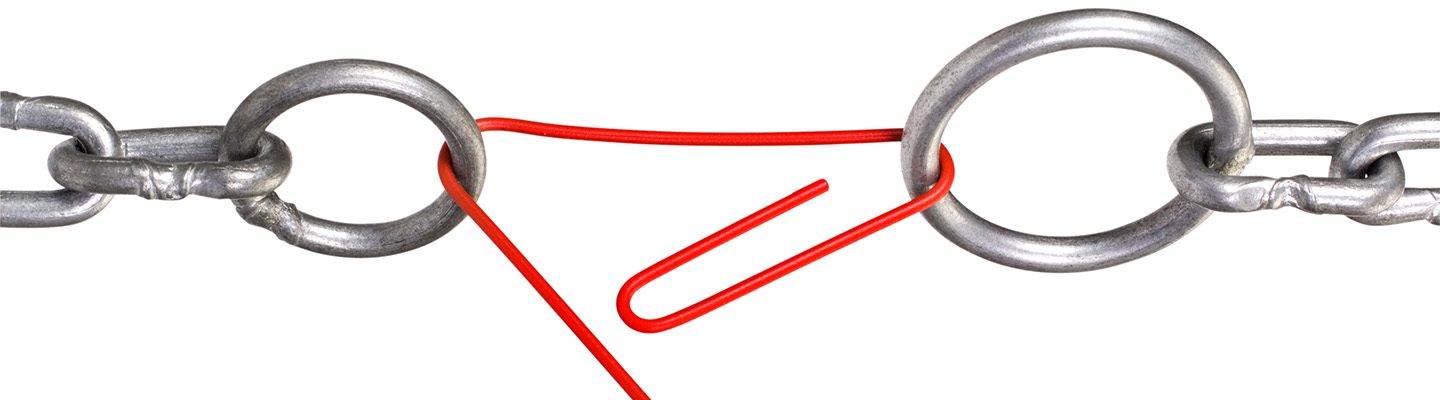

In addition to the personnel hole she left, you’re now facing a significant gap in your company’s operations because Betty was literally the only individual who knew every aspect of your company’s payroll function. What now?

Prepare For The Unexpected

Among small businesses, it’s all too common for a single individual to be responsible for an entire business function without anyone else knowing or fully understanding what they do. If that individual abruptly leaves the company for any reason, you’re thrust into crisis mode, which likely includes dealing with unpaid bills, missed deadlines, payroll grievances, the need to pay interest or penalties, and even the loss of customers and revenue.

How do you protect your business against this scenario while ensuring you never miss a beat? A business continuity plan is a great place to start.

Listen to episode 152: “Process Documentation: Crystal Clear Or Clear As Mud?” of our award-winning podcast, unsuitable on Rea Radio. To learn how processes can help your business.

How A Business Continuity Plan Can Protect Your Business

It’s easy to fall into complacency when times are good, and when your business is running like clockwork. But change – especially unexpected change – is always lurking in the shadows. As such, you should be prepared for anything. A business continuity plan outlines what you need to do to continue operating successfully amid a crisis. Potential components of your plan might include:

- Cross-training employees – to ensure continuity of a specific business function, consider cross-training two or more employees in a particular area. That way, if a person is out unexpectedly – or even takes a vacation – there’s a trained backup who knows the job.

- Developing a procedures manual – A procedures manual is a step-by-step document that outlines all critical functions of a business. It allows you to document everything you do as well as how you do it.

- Implementing a customer relationship management (CRM) system – A CRM system can provide your team with a single location to gather and share information. For example, an account manager might input notes about a customer’s account in CRM. Then, if something were to happen to the account manager, notes and information are readily available to anyone with access to the company’s CRM, allowing you to go on servicing the customer without too much disruption.

- Creating a master list of passwords – There’s pretty much a password-protected program for everything today. According to a 2017 report from LastPass, the average business user has 191 passwords. To prevent any issues in accessing the tools and programs your business uses, create a master list of passwords. It should go without saying, but you should make sure this document is secure.

- Enabling shared email access – If an employee is unexpectedly out of the office for an unknown period of time, consider sharing that individual’s email account with their supervisor. Having shared email access will ensure that emails don’t go unanswered, effectively preventing customers from going unserved.

- Outsourcing critical business units – If you’re a small business with only a few employees, perhaps outsourcing critical business functions, such as payroll or accounting, may lighten your load a bit and provide peace of mind concerning issues related to missed deadlines, paying penalties, etc.

You’re Responsible

At the end of the day, as the business owner, it’s your responsibility to know what your employees are doing. Sure, you need to be able to delegate various responsibilities so that you can work on growing your business; but at the end of the day, the onus is on you to ensure all areas of your business are covered in the event of a crisis.

If this is a new concept to you or if it seems too overwhelming to tackle on your own, reach out to me or to your Rea contact to figure out what you need to do to prepare for the unexpected.

By Candice Rowe (Avon office)