QuickTips: Tips & Tricks For Bookkeeping Success

QuickTips: Tips & Tricks For Bookkeeping Success

I hope you are off to a good New Year and that you have set some mighty goals for yourself in 2019 – personally and professionally.

When the time comes to set new goals in my own life, I find that I have greater success when I look backward. When I take this approach, I am able to use historic information to move my goals forward. Looking back allows me to assess the work I’ve done previously, whether I have been successful in my efforts and which techniques seemed to work best and which ones fell short.

Like you, my life is busy. And because I’m constantly running around and managing my responsibilities with Rea, at home and in our personal business, I really try to make an effort to keep my goals reasonable. The worse thing we can do when we are juggling so much is to set ourselves up for failure before we even have a chance to start, which is exactly what you’re doing if your goals are too lofty or if they don’t improve your life in one way or another. One of the reasons I love teaching and consulting on QuickBooks so much is because it allows me to get involved in the goals of others – to help them succeed and to cheer them on along the way. And, once they’ve accomplished their goals of doing X, Y or Z in QuickBooks, they can reap the benefit of greater organization, more time, accurate reports and more. Seriously, this type of work really is that satisfying to me!

Not only do I enjoy helping others on their own QuickBooks journey, as a true scholar committed to my own ongoing professional education, I continue to look for additional areas of improvement when it comes to my own bookkeeping practices as well.

Perhaps similar to many of you, my biggest and most important goal for the year ahead is to manage my time more efficiently. Time is our most precious commodity after all and it’s one that, once spent, can never be brought back. Therefore, in 2019, I indent to be more purposeful with my spend. To accomplish my goal, I intend to take advantage of some awesome technological advancements that have emerged in an effort to maximize the amount of work I can get done while minimizing the number of manual hours I’m putting into a given project.

Using Tech To Manage Time

Over the last year, there have been two tech solutions that have effectively proven to be game changers – Right Network and Auto Entry.

Right Networks has given me the ability to work with my QuickBooks Desktop clients from anywhere. And, when using this software, I no longer need to worry about locking the client out of the program or having to use wonky accountant copies.

Auto Entry, on the other hand, has made data entry a whole lot less painful. With this program, I can easily upload a client’s paper bank statements, let Auto Entry do its thing and, in a matter of minutes, proceed with importing the data into QuickBooks. Once there, I can easily sort transactions by the rules set up by the client. Bank statements aren’t the only document that can be processed with Auto Entry either. The software makes quick work out of receipt and invoice processing as well.

Time For Everything & Everything In Its Own Time

When dealing with the responsibilities in my family’s business, for me, I’ve found a huge time saver to be simply spending a few minutes each day inputting and categorizing transactions. I just make it a part of my daily routine. I stop by our shop every night on my way home from Rea. I handle the mail, I key in any vendor invoices that come in, receive any payments and prepare the deposit for my husband to take to the bank in the morning. It really only takes a minimal amount of time. Then, on Friday, which is typically my full day at the shop, I can focus my attention on bigger picture items that will propel our business forward.

Another sage piece of advice is not to rush. In the end, rushing actually gets you nowhere fast because you will spend more time fixing it in the end. Or, if you don’t spend the time fixing the problem, it will land on your accountant’s desk, which could end up being pretty costly.

Don’t throw away your money or your time. Just spend a few minutes every day on the little things so you won’t have to rush to play catch-up at year end. I promise it’s easy and painless and I’m not just saying that because of my bookkeeping wizard status. A little work throughout the year can truly make a world of difference! Then, while everybody else is rushing around, you can kick your feet up and enjoy a nice, cold adult beverage.

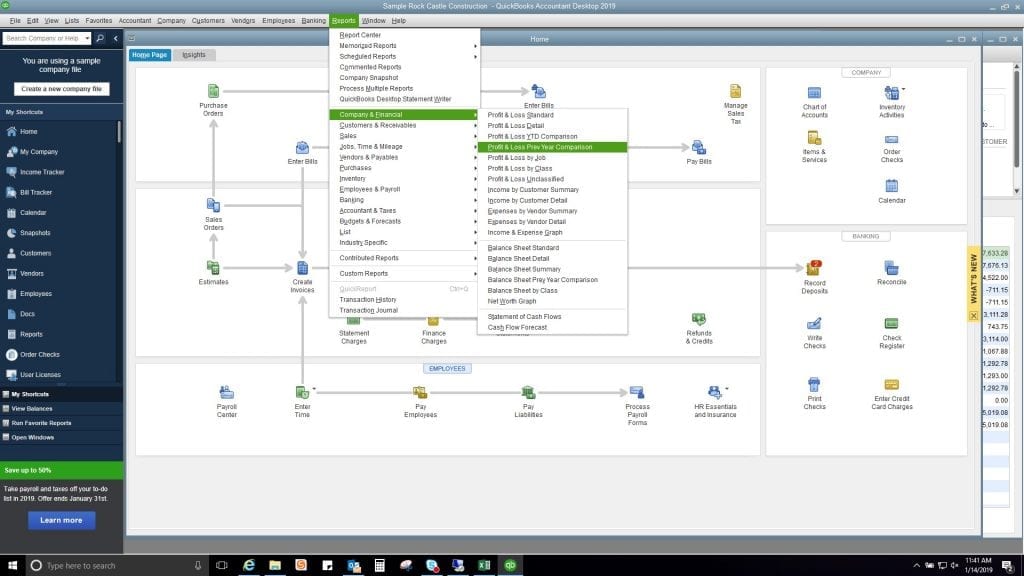

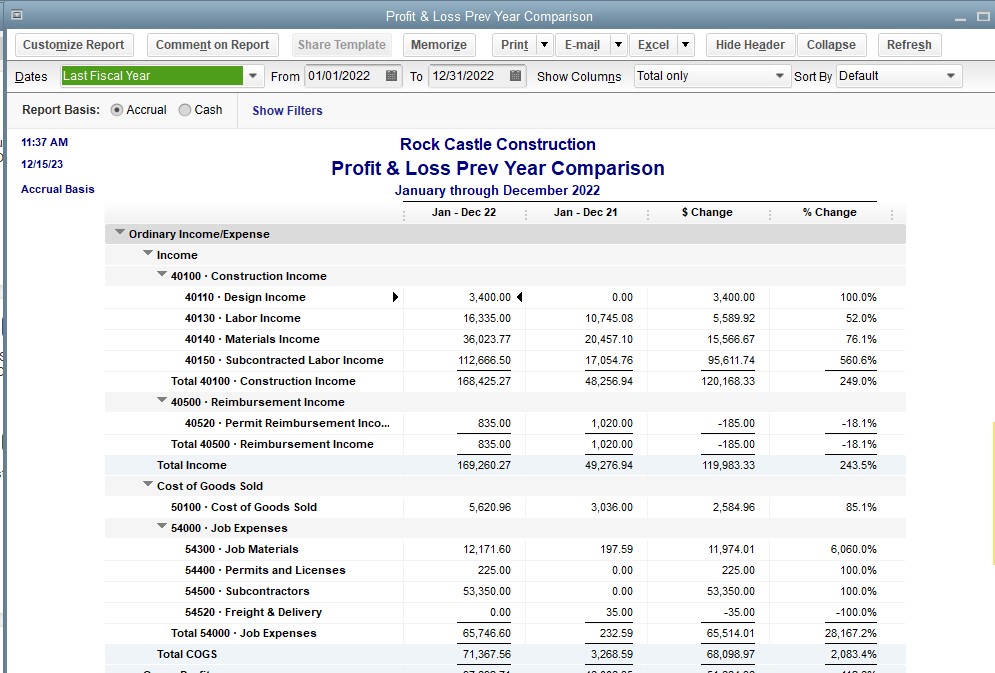

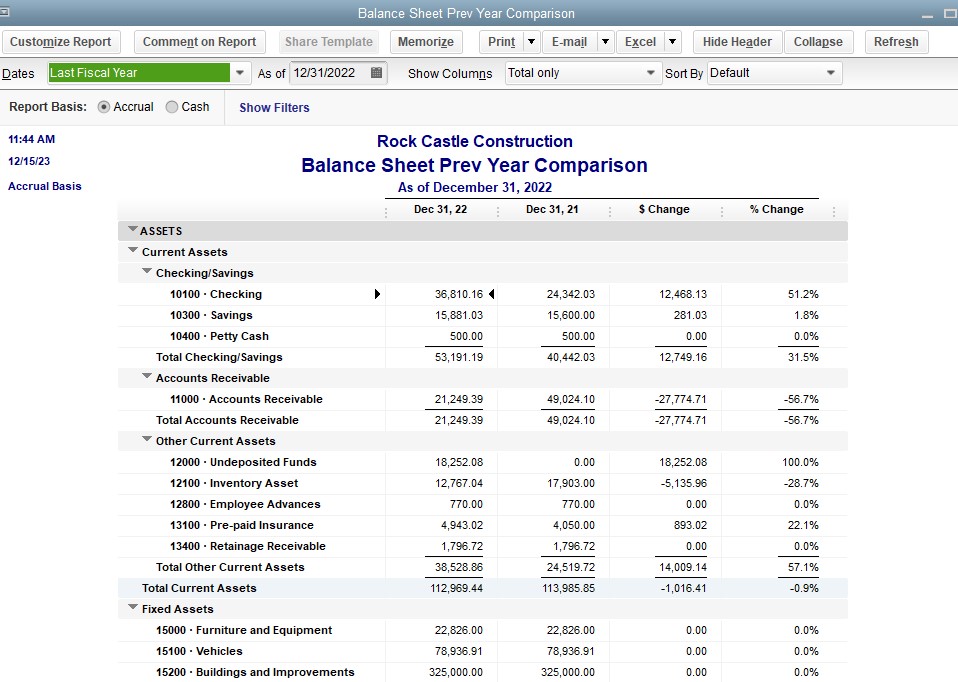

QuickTip: Compare Those Reports!

My best tip for this time of the year is to utilize previous year comparative reports in QuickBooks. If your business has remained consistent, then running these reports gives you an easy way to see if any of your accounts are grossly out of whack compared to last year. I recommend running a balance sheet and a profit and loss report. As you know, with the drill down feature you can easily pop into the accounts to confirm that everything is correct.

Comparative reports are part of our work papers for tax. Why not use the reports your accounting professionals are already using?

If you are using QuickBooks Online, you can easily find these reports in the Business Overview section. (See starred reports.)

Happy New Year!

By Matt Long (Wooster office)