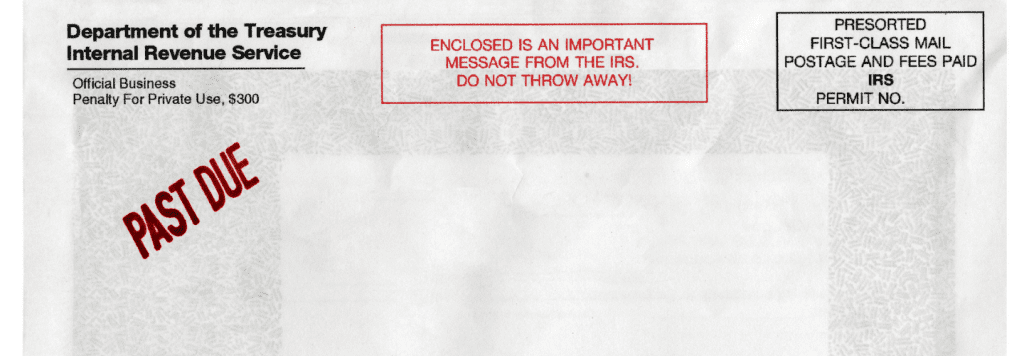

There are a few things that we can count on with the arrival of each New Year: Champagne toasts at midnight, well-intentioned New Year’s resolutions, and erroneous late notices from the IRS and DOL.

Like in years past, the IRS and Department of Labor periodically check their records to see who has filed their Form 5500 – and send late notices to those whose forms are late or outstanding. There’s just one problem: these authorities often perform these record checks before all submitted Form 5500s are entered into their system, meaning that many people get a late notice when they actually filed on time.

If you get a late notice from the IRS related to your Form 5500, but you filed on time, don’t panic. Simply let us know and we’ll advise you of next steps to clear things up with the IRS. Likewise, if you filed a Form 5558 extension request (on time) but get a notice that your request was denied because it wasn’t received by the due date on your return, we can help you navigate that as well.

Don’t just brush it off as an error and move on. If you ignore the late notice – even if it’s erroneous – the IRS won’t back down, so it’s much easier to sort things out early on. Responding directly and quickly to the IRS is the best route to avoid further disruption, and we are here to help you with that.

If you believe you’ve received a late notice in error, please contact your Rea advisor.

By Paul McEwan, CPA, MTax, AIFA (New Philadelphia Office)