Editor’s Note: This is a really popular time of year for those who are looking to make considerable donations to not-for-profit organizations. However, whether or not your donation is tax-exempt depends on the organization’s status with the IRS. Because so many people are looking for answers, we’ve decided to update and re-publish this helpful article about the IRS’s Tax Exempt Organization Search Tool. Enjoy!

How To Uncover A Nonprofit’s Tax-Exempt Status

There are many reasons why you might want to look up an organization’s tax-exempt status. However, more often than not, if you’re searching for this information, it’s probably because you are considering making a donation to a particular nonprofit and you want to make sure it is a reputable organization.

Fortunately, the IRS has a tool that is designed to provide donors with the peace of mind they’re looking for.

EO Select Check To The Rescue

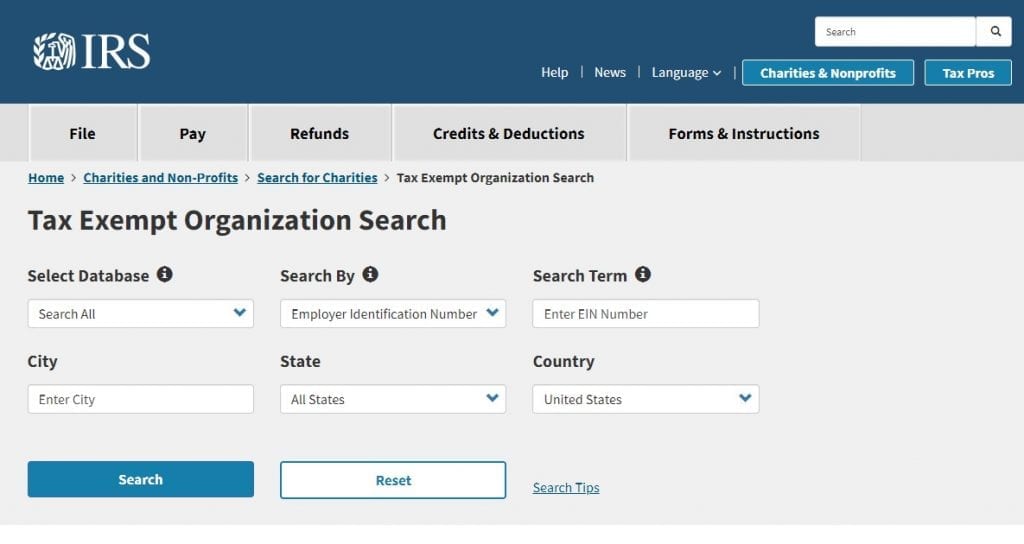

Tax Exempt Organization Search gives users the ability to search for charities online and provides them with the organization’s federal tax status and filings.

This tool is great for donors who want to confirm whether an organization is tax-exempt and, thus, eligible to receive tax-deductible charitable contributions. It can also reveal if the organization you searched has had its tax-exempt status revoked, which can occur if the nonprofit failed to file its Form 990 or notices annually.

What EO Select Check Won’t Tell You

Before you conduct your search query using the Exempt Organizations Select Check, there are a few things to keep in mind. First, there are certain organizations that may not be listed even though they are eligible to receive tax-deductible donations, including churches, organizations in group ruling and governmental entities. Secondly, you won’t be able to search for an organization’s “doing business as” name. Rather, to find the organization you’re looking for, you must use its legal name.

Can You Deduct Your Donation?

And if you need a little more help determining whether or not your nonprofit donation is tax-deductible, try using the IRS’s Interactive Tax Assistant, “Can I Deduct My Charitable Contributions?” tool.

This process will take about 12 minutes to complete and the conclusions made are solely based on the information you provided in response to the questions asked. To take advantage of this feature, you’ll need:

- Your and your spouse’s filing status.

- Your adjusted gross income amount.

- Amounts donated and to what organizations.

- Any appraisal or information you have to determine the fair market value of a donation for noncash contributions.

Alternatively, if you are still scratching your head or are looking for help maximizing your charitable giving dollars, reach out to the accounting and tax professionals at Rea & Associates for assistance.

Looking for more assistance? Check out these resources:

Tax-Exempt Determination Letters, Financial Data Now Available Online