The new credit loss standard (CECL) received airtime from many constituents over the last month — from the U.S. House Committee on Financial Services to Staff from the U.S. Securities and Exchange Commission (SEC) and Financial Accounting Standards Board (FASB) — related to application and documentation matters. CECL is effective for calendar year-end issuers on Jan. 1, 2020.

U.S. House Committee on Financial Services

Based on a Dec. 11, 2018 congressional hearing, it appears that the new credit loss accounting standard is not a “done deal.” In that hearing, the U.S. House Committee on Financial Services spent nearly two hours debating the benefits and costs of CECL with industry experts. The general consensus was twofold:

- FASB needs to conduct a thorough industry-wide cost-benefit analysis on the impact of CECL to the financial services industry before the required effective date.

- Regulatory capital relief is a must to avoid penalizing an institution’s regulatory capital ratios upon adoption.

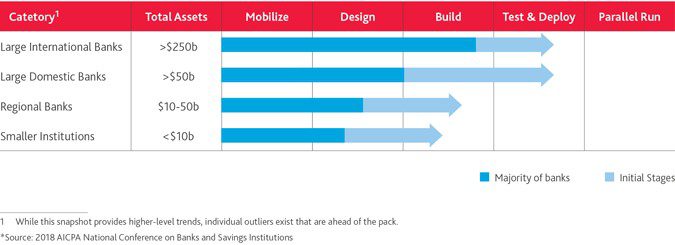

While FASB seems reluctant to reopen debate on a delay of CECL’s effective date, it’s clear that they are coming under considerable bi-partisan pressure to do so. Despite this current uncertainty, public and private institutions should prepare for CECL implementation in earnest. As the CECL implementation date of Jan. 1, 2020 nears for public company filers, much progress has been made by the largest banks to prepare their systems and processes. However, many smaller institutions are just getting started, including public regional banks less than a year away from required compliance. The following chart* shows the current progress of the industry in regard to CECL preparation by category:

SEC and FASB

The Staff at the SEC and FASB continue to study and evolve their understanding of CECL, issuing guidance for specific factors related to CECL application. Recently, SEC Staff shared observations from two application-related consultations. In one, the issuer concluded it would assess loans at the individual loan level for determining when they should be charged off because the loans retain their individual characteristics, even though CECL requires pooling loans with similar risk characteristics to determine the allowance. In another consultation, at issue was whether portfolio-level information should be considered in determining collectability, since CECL is silent on assessing collectability. The issuer concluded it should consider all relevant information, including individual loan information and historical losses on similar loans, when deciding a loan is uncollectable. The SEC Staff did not object to either conclusion.

The SEC Staff also shared their views regarding the application of ASC 855, Subsequent Events, to the forward-looking estimates required by CECL. Fact patterns were discussed wherein information may be received after the balance sheet date (but before financial statement issuance) that could be significantly different from management’s original expectations. The conclusions reached varied:

- Loan-specific information about conditions that exist at the balance sheet date would be recognized.

- Information that is not loan-specific (e.g., the U.S. government’s announcement of unemployment rates) received after the completion of the estimation process would not be recognized, unless the information results in an identified deficiency in the institution’s CECL calculations, thus requiring the information to be included.

- Information relating to forecasting assumptions received before the completion of the estimate process could be included if management chooses to do so, unless the information results in an identified deficiency in the institution’s CECL calculations, thus requiring the information to be included.

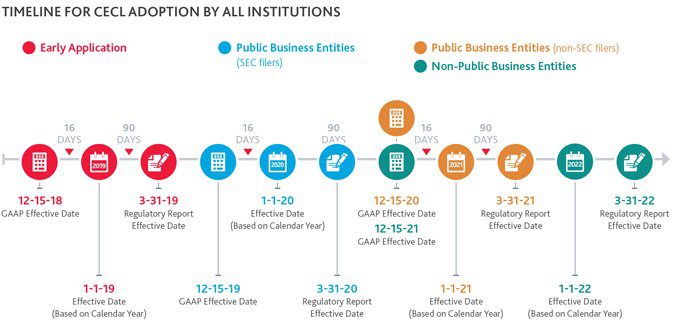

The FASB also made a change to its implementation timeline for private institutions—the deadline for adopting CECL has moved to fiscal years beginning after December 15, 2021 (versus 2020 as originally written). The current timeline for CECL adoption is shown below:

Federal Reserve Board

The Federal Reserve has been busy designing and approving a three-year transition period to allow institutions (both public and private) the option to phase in the impact of CECL on regulatory capital upon adoption. To this end, the federal bank regulatory agencies approved a final rule modifying their regulatory capital rules and providing an option to phase in the day-one regulatory capital effects of CECL adoption over a period of three years. The final rule will take effect April 1, 2019. Banking organizations that choose to adopt CECL early may elect to adopt the new rule as of the first quarter of 2019.

On the Horizon

Additional guidance on CECL is forthcoming. The SEC’s Office of the Chief Accountant is in the process of updating Staff Accounting Bulletin (SAB) 102, Selected Loan Loss Allowance Methodology and Documentation Issues, to conform with the concepts in CECL. The updated guidance is expected to be issued in 2019.

On the FASB front, at its most recent accounting standards setting update, Staff announced it expects to share an exposure draft in early 2019 on a one-time election to apply the fair value option on an instrument-by-instrument basis in lieu of adopting CECL. FASB also plans to hold a public roundtable on CECL implementation issues in January.

In the meantime, debate about CECL rages on, as industry and lawmakers alike reiterate concerns about the long-term economic impact.

Making Progress Amid Uncertainty

The American Bankers Association has called CECL, “the most sweeping change to bank accounting ever.” Transitioning to CECL has indeed proven to be complex and time consuming. Financial institutions, in particular, face the heaviest implementation burden. Not only does CECL impact your internal accounting policies and procedures, it may have a material impact on your financials and how you manage your capital. CECL’s expanded data requirements, which include both internal and external data points, may ultimately prove the biggest challenge for organizations with less sophisticated data management programs.

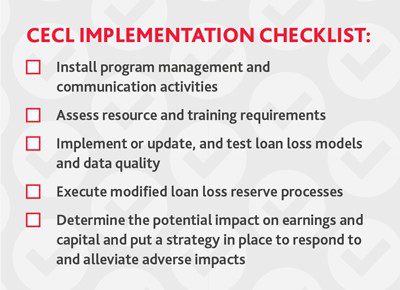

Included below is our CECL Implementation Checklist for preparing for implementation throughout 2019. While private institutions have been granted an extension for CECL implementation, it’s critical that they begin their planning and assessment phases now. In general, the larger institutions are finding that it takes between 12 to 18 months to fully prepare for CECL compliance, so time is of the essence.